Key Strategies for Investing in Real Estate

You’ll be making a big mistake if you are not using these strategies if you plan on investing in 2024 and 2025.

I get asked a lot, “What are you doing, Greg, to prepare yourself and where are you going to go?” I take a very analytical approach to this question. Believe it or not, people who know me, know I tend to brood over things, use a lot of charts and data, and I have even developed a software system to determine the best market for the best return. It all starts with people.

The Importance of Migration Patterns

Strategy #1: Start With People

Anytime you’re looking at real estate, it always starts with people. Whether you’re doing multifamily, retail, industrial, or any commercial asset class, you need people to utilize the facilities you’re developing or acquiring. Demand goes back to where people are migrating from. Migration patterns have been a hot topic in the news for the past few years.

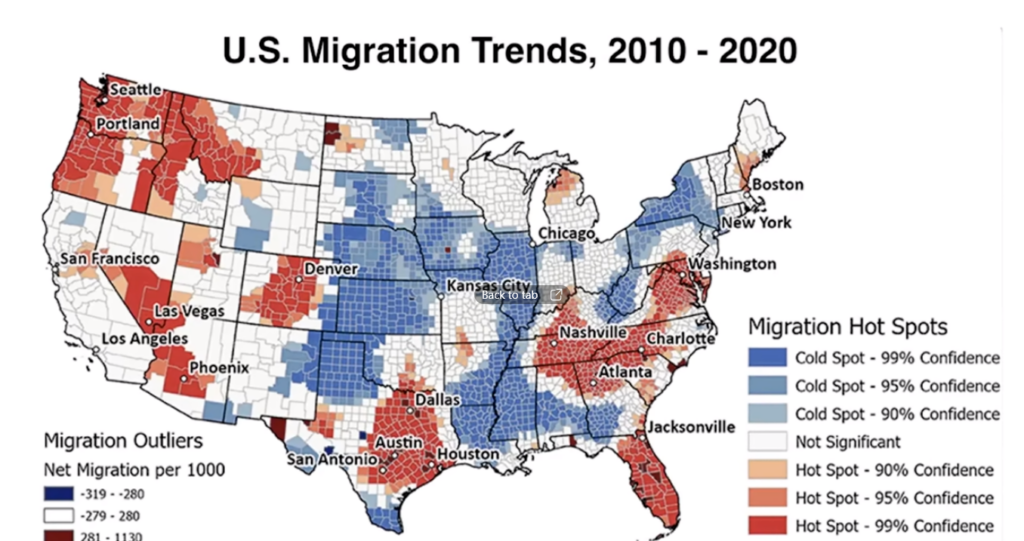

Not to over politicize, but some areas, demographically and geographically, have been in the news daily. For those of us in real estate, there’s a wealth of information—charts, data, graphs—to help us make great decisions. One chart in particular shows migration patterns and tells a story of what’s happening across the U.S.

From this graph (below), you’ll see significant migration into “hot spots,” often forming triangular areas between major cities. For example, the Texas Triangle (Dallas, Austin, Houston), and the region from Nashville to Charlotte to Atlanta. Northern Florida, from Jacksonville to Miami Beach, is also a hot spot.

- Migration Patterns:

- Focus on areas with high migration trends, as these will have the highest demand.

- These patterns are critical. You need people to support your rent, which drives your revenue and ultimately your property valuation.

- Demand and Supply:

- Look for areas where demand is high, even if currently oversupplied. Places like Austin have seen a dip in rents due to oversupply, but this presents a buying opportunity.

- There’s typically a 2-3 year lag from permit to market supply. This timing is crucial for predicting when to enter the market.

- Supply vs. Demand Timing:

- Understand the lead-lag relationship between demand and supply. High demand followed by high supply usually results in a buyer’s market.

Market Timing and Cycles

Strategy #2: Understand Cycles

The real estate market is cyclical. During the pandemic, projects were permitted at low interest rates and started construction, but the supply didn’t hit the market until years later. Now, those projects are coming online, leading to an oversupply and suppressed rents, creating a buyer’s market.

Case Study: Albuquerque

Let’s take a look at Albuquerque to illustrate these points. In Q1 of 2021, Albuquerque had high occupancy and high supply, but as time passed, the market became oversupplied, reducing occupancy rates. This pattern is common across various markets, including Austin and Colorado Springs.

For instance, in Albuquerque, a property built in 1986 with 572 units shows a 93% occupancy rate and no concessions. Such data helps identify properties under pressure and ripe for acquisition.

Have Tools In Place

Strategy #3: Use Tools To Be An Expert

Whether you are a seasoned investor or new to the game, it is important to have tools in place to help you understand the assumptions and give you an accurate return calculation. I found this to be so crucial I created a software platform to help me make better investment decisions.

Final Thoughts

To succeed in the 2024-2025 market, focus on:

- Migration patterns to identify high-demand areas.

- Markets where current oversupply suppresses rents, as these present acquisition opportunities.

- Using detailed data tools to pinpoint specific properties for investment. In short, be an expert at financial modeling.

Stay analytical, use the data available, and understand the market cycles. Remember my E3 Formula: Educate, Evaluate & Execute

.